By Mukethwa Chauke – Johannesburg

The concept of succession is not a foreign concept in our African legal system. In customary law the heirs of the deceased were determined through the male line ,referred to as the male primogeniture rule, which is well known to discriminate against women. Only the eldest legitimate son of the deceased could inherit, to the exclusion of the other siblings. The customary rule of male primogeniture was declared invalid and unconstitutional by the Constitutional Court in a landmark case of Bhe v Magistrate Khayelitsha 2005 (1) SA 580 (CC), as the rule infringed the rights of equality and human dignity.

The concept of succession is not a foreign concept in our African legal system. In customary law the heirs of the deceased were determined through the male line ,referred to as the male primogeniture rule, which is well known to discriminate against women. Only the eldest legitimate son of the deceased could inherit, to the exclusion of the other siblings. The customary rule of male primogeniture was declared invalid and unconstitutional by the Constitutional Court in a landmark case of Bhe v Magistrate Khayelitsha 2005 (1) SA 580 (CC), as the rule infringed the rights of equality and human dignity.

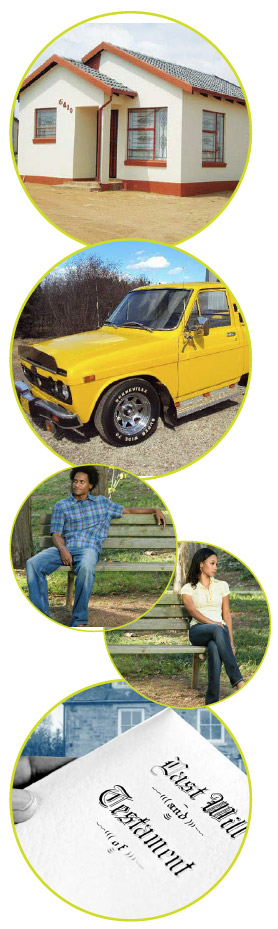

When a person dies and leaves assets, a deceased estate comes into existence and it must be distributed through the application of testate or intestate succession law.

Testate succession is where the deceased died having left a valid Will. The wishes of the deceased person will be carried out according to what the Will says.

Intestate succession is where the deceased died without a Will or with a Will which was later rejected by the Master of the High Court (the Master) and/or declared invalid by the High Court for certain reasons. In this regard the deceased estate will be distributed through the application of the Intestate Succession Act 81 of 1987.

The deceased estate must be reported to the Master in whose area of jurisdiction the deceased was living prior to his or her death. The estate must be reported within 14 days from the date of death, and any person who is in possession of the deceased person’s Will and/or has control over any of the deceased assets can report the death.

The Master will appoint an executor to the deceased estate. The appointment differs depending on the value of the deceased estate and is regulated by section 18(3) of the Administration of Estates Act 66 of 1965 (the Act).

If the value of the estate is more than R250,000 the heirs of the deceased must nominate an attorney who will wind up the estate and prepare and lodge the liquidation and distribution account (hereinafter referred to as the L&D account) with the Master. The L&D account is governed by the provision of section 35 of the Act, and once the Master has approved the L&D account a Letters of Executorship will be issued. Where the value of the estate is less than R250,000 the Master may issue Letters of Authority.

When the Master issues Letters of Authority it is free of charge and legal assistance is not necessary. However, property values are regularly increased by municipalities and this affects the destitute in a negative manner when they want to wind up their loved one’s deceased estate through the process of obtaining Letters of Executorship without the use of a private attorney. If the legal costs are unaffordable to the heirs, it results in many deceased estates not being wound up.

Through my experience as a legal intern at ProBono.Org, I have come across various kinds of deceased estate disputes among siblings. One of the most common is when an heir fraudulently transfers the deceased’s immovable property into his/her name to the exclusion and detriment of the other siblings who are the rightful heirs of the deceased. The unscrupulous sibling may go as far as selling the immovable property, even when the deceased’s family is occupying the property, to the extent that they end up being illegally evicted from the property.

All the rightful heirs are entitled to the deceased estate, whether in testate or intestate succession. One heir cannot legally act on their own, but must obtain consent from the other heirs. A property that has been fraudulently transferred or sold to a third party without the knowledge or consent of the rightful heirs of the deceased can be challenged, and the ownership or sale of the property declared null and void.

The moment a person dies his or her assets are frozen. If the deceased owns immovable property and has left money and/or any policies, his or her beneficiaries will not be able to claim if the Master has not appointed an executor of the deceased estate.

In conclusion, drafting a valid will is advisable as it can minimise the difficulties that might transpire when administrating the deceased estate, the testator has the freedom to indicate what should happen to their assets, who are the heirs and also to nominate the executor of their choice. Any person older than 16 years can draft a valid will. ProBono.Org offers this service free of charge.